portland oregon sales tax rate 2020

What is the tax rate in Portland Oregon. To this end we show advertising from partners and use Google Analytics on our website.

States With Highest And Lowest Sales Tax Rates

Ad Find Out Sales Tax Rates For Free.

. According to Metro the current average assessed value of a Portland home is just 231000. The tax must be paid before the vehicle can be titled and registered in Oregon. Oregon cities andor municipalities dont have a city sales tax.

There are six additional tax districts that apply to some areas geographically within Portland. The County sales tax rate is. Over the years the tax rate has increased from 6 in 1976 to 146 in 1992.

1 2020 will qualify only for a tax credit that will be available on residents 2020 tax return. The rate is applied to the net business income. The Portland Sales Tax is collected by the merchant on all qualifying sales made within Portland Portland Oregon Sales Tax Exemptions In most states essential purchases like medicine and groceries are exempted from the sales tax or eligible for a lower sales tax rate.

Portland Tourism Improvement District Sp. Sales tax region name. Oregon cities andor municipalities dont have a city sales tax.

Businesses that are operating within the City of Portland andor Multnomah County including rideshare drivers must register for a Revenue Division tax account within 60 days. The highest mill-rate is within the City of. Instead of the rates shown for the Portland Tourism Improvement District Sp tax region above the following tax rates apply to these specific areas.

Over the years the tax rate has increased from 6 in 1976 to 146 in 1992. In 2019 and 2020 Portland and Oregon will impose new gross receipts taxes. Portland metropolitan area comprises Clackamas Columbia Multnomah Washington and Yamhill Counties in Oregon and Clark and Skamania Counties in Washington.

You are generally considered to be doing business in the City of Portland. In fact the success of the Washington County taxes have prompted the Oregon Legislature to introduce bills restoring the transfer tax across the state. The December 2020 total local sales tax rate was also 0000.

A home tax assessed at 242000 a real market value of 390K with a mill-rate of 1640 would owe annual property taxes of 3968. The rate was reduced to 145 in 1993 when the City and County achieved code conformity and joint administration of the two separate programs. Apportionment may be allowed for business activity performed outside the County.

The Clean Energy Surcharge CES and the Corporate Activity Tax CAT respectively. The minimum tax would be in addition to the 100 minimum tax described in Section 702545 if applicable. Please complete a new registration form and reference your existing account 3.

The Oregon sales tax rate is currently. That means that your homes value may stay the same this year or even go down a little bit but in the parallel universe of Oregon property taxes the value is still going up 3. Any contributions you make in tax years that begin on or after Jan.

Taxpayers may submit a waiver request along with. The rate was reduced to 145 in 1993 when the City and County achieved code conformity and joint administration of the two separate programs. However Oregon does have a vehicle use tax that applies to new vehicles purchased outside of the state.

The minimum Heavy Vehicle Use Tax due for a tax year is 100. The minimum combined 2022 sales tax rate for Portland Oregon is. Oregon does not collect sales taxes of any kind at the state or local level.

Combined with the state sales tax the highest sales tax rate in Oregon is NA in the cities of Portland. Fast Easy Tax Solutions. In Multnomah County the average tax rate is 2012 per 1000 of assessed value but the average homeowner is taxed 987 per 1000 of real market value.

Click here for a larger sales tax map or here for a sales tax table. For more information and a flowchart to determine if vehicle use tax is due. Oregon uses the Oregon Business Registry Resale Certificate for Oregon buyers who buy goods outside.

Required every tax year. For the tax years beginning on or after January 1 2020 this tax is 3 percent of the total Oregon Weight-Mile Tax calculated for all periods within the tax year. The tax rate or mill-rate is charged per 1000 of tax assessed value.

This is the total of state county and city sales tax rates. If a taxpayer would have met the 90 threshold under the prior years rate 145 for tax year 2020 but does not meet the 90 threshold under the new BIT rate 200 quarterly interest will be waived. The Oregon State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Oregon State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

But assessed value still has a long way to go to catch up to real market value. Portland OR Sales Tax Rate The current total local sales tax rate in Portland OR is 0000. While the bills did not pass in 2020 the governor still plans to pursue the increases over the future so tax rates may change at any time.

The Oregon Department of Revenue is responsible for publishing the latest Oregon. The Portland sales tax rate is. In the Portland Metro area mill-rates range from 1500 to 2030.

The mill-rate varies from one community to another. Oregon has no state sales tax and allows local governments to collect a local option sales tax of up to NAThere are a total of 55 local tax jurisdictions across the state collecting an average local tax of NA. Oregon Sales Tax Oregon does not collect sales taxes of any kind at the state or local level.

There is no applicable state tax. Oregon doesnt have a general sales or usetransaction tax. Tax rates last updated in January 2022.

Registration Requirements City of Portland Business License Tax andor Multnomah County Business Income Tax. Join speakers Nikki Dobay Senior Tax Counsel at Counsel On State Taxation COST Dan Eller Shareholder at Schwabe Williamson Wyatt and Valerie Sasaki Partner at Samuels Yoelin.

States Without Sales Tax Article

Sales Taxes In The United States Wikiwand

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Sales Tax Rates In Major Cities Tax Data Tax Foundation

2021 Portland Tax Changes Bluestone Hockley Portland Property Management

Sales Taxes In The United States Wikiwand

Historical Oregon Tax Policy Information Ballotpedia

States Without Sales Tax Article

States With Highest And Lowest Sales Tax Rates

Is It Possible To Buy A New Apple Device Without Any Sales Tax Appletoolbox

Montana Tax Information Bozeman Real Estate Report

States Without Sales Tax Article

2021 Portland Tax Changes Bluestone Hockley Portland Property Management

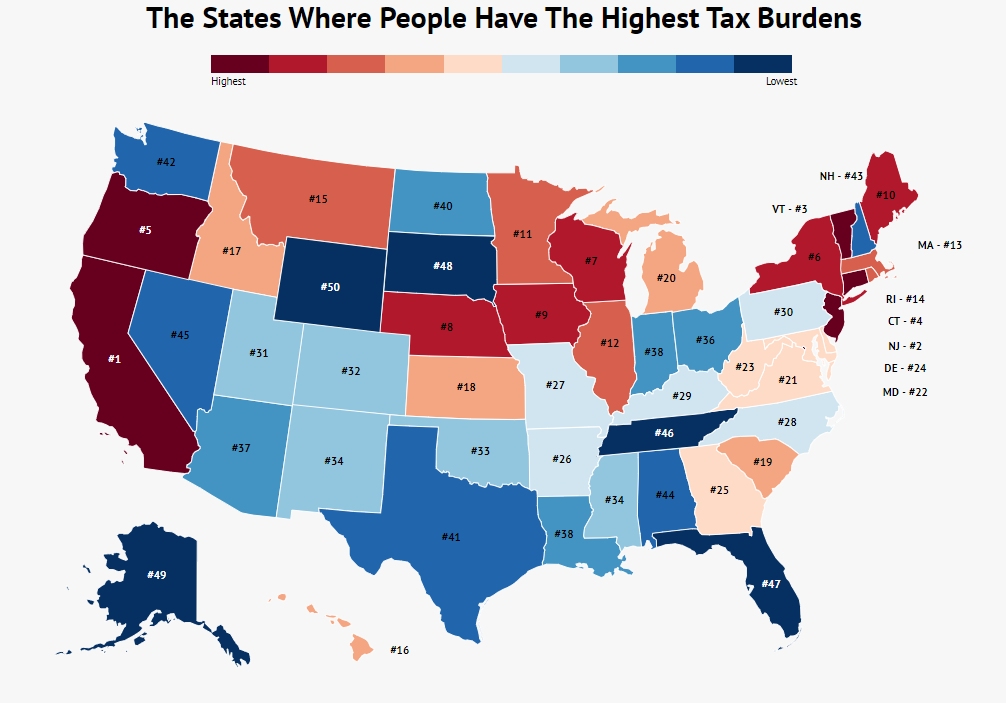

The States Where People Are Burdened With The Highest Taxes Zippia

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Sales Tax By State Is Saas Taxable Taxjar

Travel Oregon Stunning Coast Great Outdoors Oregon Travel Portland Travel Beautiful Places To Visit